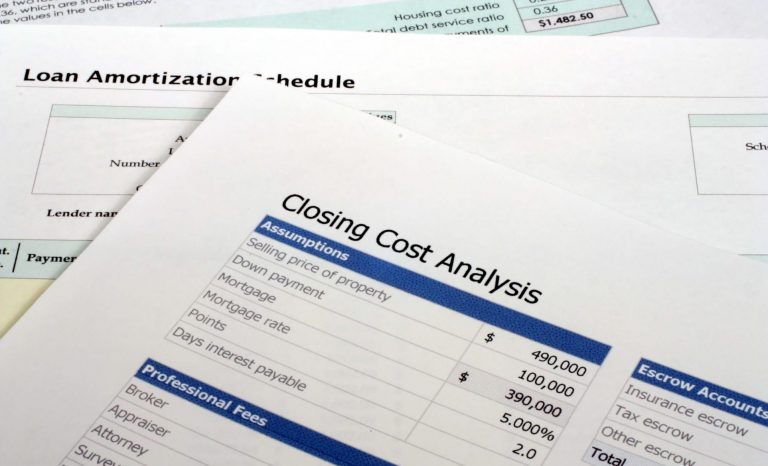

While securing a mortgage at today’s rates is more affordable than ever, it’s crucial not to overlook the additional financial responsibilities that come with buying a home: the closing costs. These expenses, necessary and legally mandated in most cases, can accumulate significantly and should be factored into your overall budgeting plan.

Here’s a breakdown of the major closing costs you’ll likely encounter:

- Legal Fees: A lawyer plays a vital role in your home-buying process, and their services come with fees. These usually cover title searches, arranging property surveys, and managing other necessary disbursements.

- Mortgage Insurance and Application Fee: If your mortgage covers 75% or more of the home’s purchase price, it’s considered a high-ratio mortgage and requires insurance. This fee is to ensure the lender is covered in case of default.

- Mortgage Broker’s Fee: If you’re working with a mortgage broker, be aware that their services may include a fee, particularly if they are arranging the mortgage. Sometimes, this fee is included in the legal fees or the lender’s charges.

- Property Insurance: Covering the replacement value of your home and its contents, this insurance is typically a prerequisite by lenders before finalizing a mortgage.

- Home Inspection Fee: Hiring a professional home inspector can provide peace of mind and additional information about the state of the property. Inspection fees generally range from $150 to $300, depending on the house.

- Land Transfer Tax: In Ontario, as in many other places, buying property entails paying a land transfer tax. This tax varies but typically ranges from 0.5 to 2 percent of the home’s purchase price.

- GST: The Goods and Services Tax applies to some extent on new home purchases, with available partial rebates. Resale homes are often exempt, but other closing costs might still require GST payments.

- Additional Charges: Be prepared for other expenses, such as reimbursement to the seller for pre-paid costs like heating oil, or other similar charges.

- Utility Hook-Ups: Setting up services and appliances in your new home may incur charges from utility companies, including telephone, cable, electricity, etc.

- Moving Expenses: Last but certainly not least, don’t forget the cost of moving, especially if you plan to hire professional movers.

Your REALTOR® can offer more detailed insights into these closing costs. Remember, integrating these expenses into your financial strategy is essential when planning to purchase a home. By being aware and prepared, you can ensure a smooth transition into your new home without unexpected financial surprises.